During my time at Lyft, I was part of the Lyft Garage product team - Lyft’s big bet on redefining car ownership by offering car maintenance, parking, and roadside assistance to users. My key focus was defining improvements to the roadside assistance MVP and increasing customer satisfaction to drive up conversion of Lyft Pink members.

Skills Showcased:

Problem discovery and root cause analysis

Cross-functional collaboration with engineering, CX, and vendor teams

Customer-centric UX and communication improvements

Data-informed prioritization and roadmap planning

Go-to-market execution with phased rollout strategy

Operational risk mitigation and trust management

KPI definition and success tracking

Vendor performance management and quality control

PRD

Summary

As part of a larger initiative to expand beyond rideshare, we launched Lyft Garage, a product suite focused on car ownership services for riders—including Roadside Assistance, Parking, and Car Maintenance. Roadside Assistance emerged as the key growth driver, offering Lyft Pink members coverage that rivaled incumbents like AAA. However, the product’s dependence on third-party tow partners introduced major fulfillment challenges—ranging from inaccurate live-tracking data to service inconsistencies and fraud. These issues directly impacted trust, customer satisfaction, and conversion to Lyft Pink. To address this, we will focus on improving ETA accuracy, service reliability, and communication—resulting in a smoother customer experience and a more credible value prop for membership growth.

Goals

Decrease fraudulent or scam-related roadside incidents by 80%

Raise average CSAT score from 3.0 → 4.0

Increase Lyft Pink conversions from 200K → 500K, with Roadside as a core driver

Reduce inbound customer support volume related to ETA discrepancies by 30%

Project Scope

This work will span product, engineering, customer experience, and third-party operations. It will involve improving the accuracy of vehicle tracking in the Lyft app, tightening SLAs and data fidelity from our roadside partners, and improving how users are updated throughout the service experience. MVP will focus on location sync, fraud flagging, and push notification enhancements. Scope will exclude major changes to partner onboarding systems or full-scale replatforming of the underlying tracking system.

Requirements

P0 – Must-Haves (Launch Blocking):

We will update app logic to improve the accuracy of tow vehicle GPS tracking, ensuring regular refreshes and fallback logic when GPS data is stale

We will integrate more reliable ETA estimations from our third-party roadside partner, with guardrails for timeout or no-movement detection

We will introduce push notifications and in-app banners that proactively update users on delays, ETAs, or reroutes

We will build a provider risk scoring model using CSAT data, fraud reports, and completion rates—automatically flagging and deprioritizing low-trust partners

All updates must meet SLAs for incident communication timing and app reliability metrics

P1 – High Impact Features (Enhance Utility):

We will implement a backend trigger that automatically removes underperforming providers after X flagged incidents or poor customer scores

We will introduce a “live-truck view” map feature showing step-by-step ETA countdowns with real-time refreshes

CS and ops teams will have access to a dashboard that surfaces provider performance and user complaints in near real time

We will provide a set of macros and agent training to ensure consistent support escalation paths and response quality

Public-facing FAQ and trust messaging will be updated to clearly communicate what users can expect from the service

P2 – Future Enhancements (Post-MVP Quality-of-Life):

A real-time service reliability score will be shown in-app per region based on recent fulfillment metrics

A CSAT micro-survey will be embedded post-service to capture insights immediately after resolution

We will consider surfacing provider profiles with reviews for added transparency and trust

Integrations with membership acquisition flows will dynamically showcase positive CSAT trends in Roadside to boost Pink conversion rates

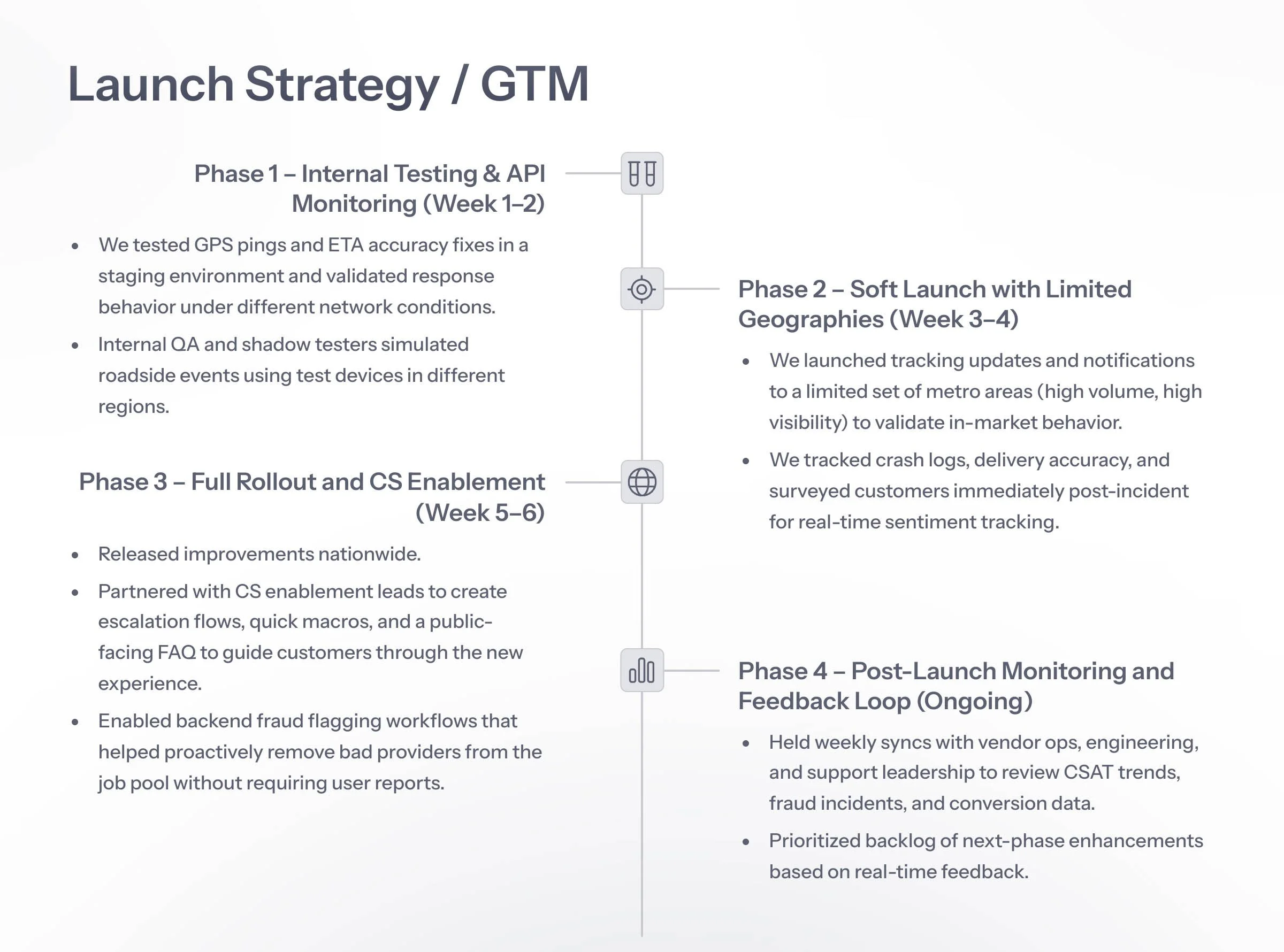

Launch Plan / GTM

Given the operational risk of delivering a poor user experience during emergencies, we will roll out in controlled phases:

Week 1–2: Internal Testing & Provider QA

QA GPS and ETA fixes in staging environments under different bandwidth and phone conditions

Sync with third-party partners to validate that API logic, vehicle updates, and completion statuses are being reliably passed

Week 3–4: Pilot Launch in Select Markets

Release tracking and notification updates in 2–3 high-volume markets (e.g. LA, NYC, Austin)

Monitor CSAT feedback and GPS movement patterns in live jobs; collect and categorize early issue reports

Week 5–6: Full Rollout and CS Enablement

Launch updates nationwide, paired with CS onboarding docs, macros, and escalation flows

Begin proactive flagging/removal of low-performing providers based on updated rules

Launch marketing refresh to clarify expectations and build user trust in Lyft Pink roadside coverage

Ongoing: Feedback Loop and Optimization

Weekly syncs with CS, Product, and Ops to triage flagged cases

Plan Phase 2 features based on uptake, NPS, and fraud trends

Refresh internal dashboard weekly with key KPIs to identify new hotspots or regional risk clusters

Success Criteria

CSAT increases from 3.0 → 3.8+ within first 5 weeks of rollout

Tow fraud/scam reports decrease by 80%+ as flagged providers are removed

Support tickets referencing “truck not moving” or “no ETA” drop by 30%

Roadside-related Lyft Pink conversions increase by 8–10%, based on post-service surveys and onboarding attribution

Measurement Plan

Track live job data to compare ping frequency and ETA variance before and after rollout

Monitor CSAT and fraud report volume segmented by region and provider

Measure conversion lift for Lyft Pink in relation to positive post-roadside experiences

Audit support macros and customer escalations for consistency and sentiment

Risks

If GPS fixes are only partially effective, user trust may further erode due to over-promising

Misaligned SLAs or missing provider data could cause confusion or increased escalations

Over-removal of providers without regional backup may lead to unfulfilled jobs in smaller markets

If the communication strategy isn’t clear, users may still default to contacting support—even if the tracking is improved