An impactful project I took on at Tempo Fit involved tackling pandemic-related shipping delays that were hurting customer retention. By proactively leveraging unused inventory to fast-track deliveries, my team reduced cancellations by 30% and saved the company over $2M in storage costs.

Skills Showcased:

Problem discovery and root cause analysis

Cross-functional collaboration with logistics and support teams

Data-driven decision making using customer behavior and ops metrics

Solution design and operational rollout

Rapid experimentation and phased go-to-market execution

PRD

Summary

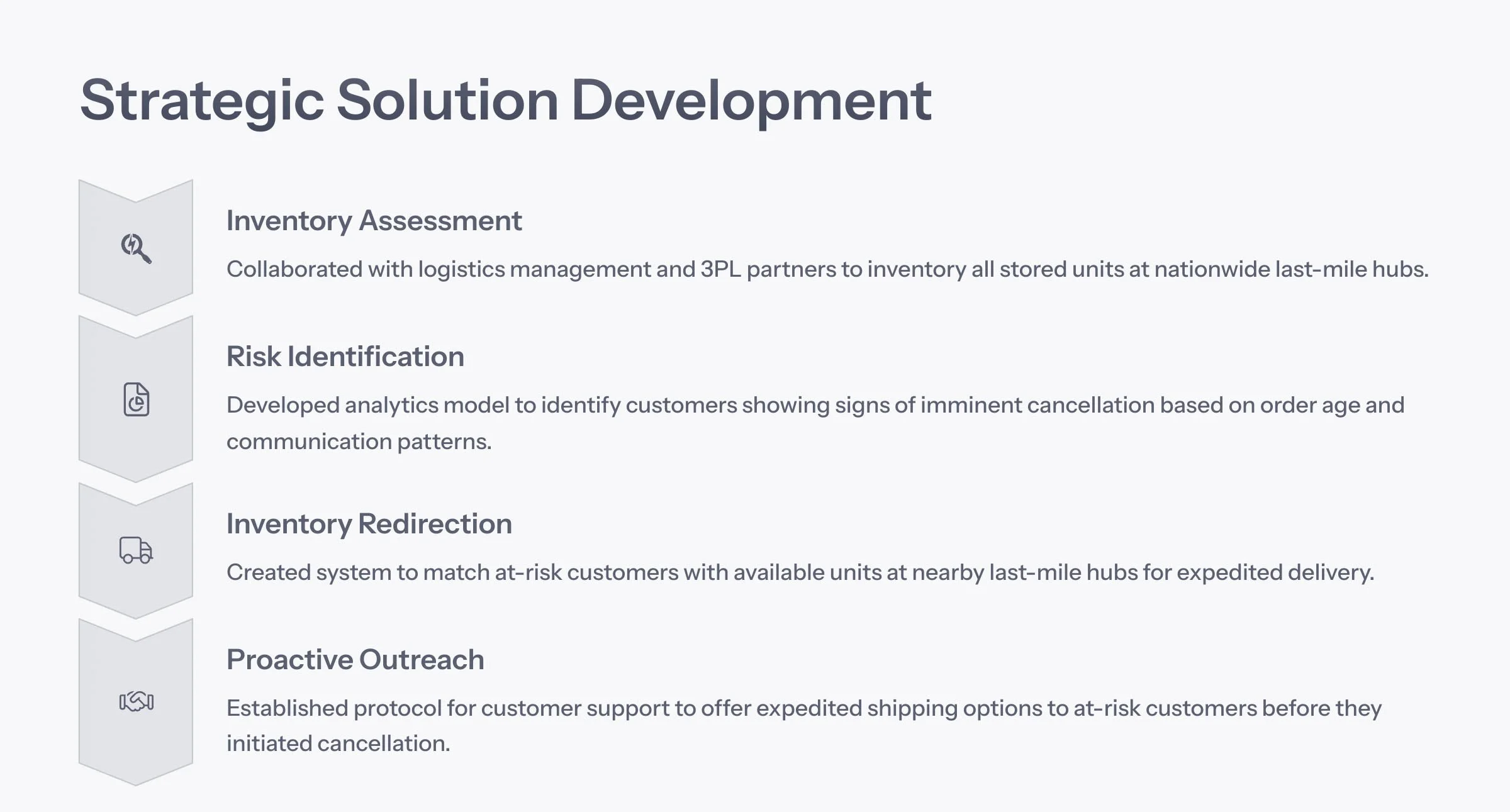

During periods of elevated shipping delays—particularly those caused by pandemic-era congestion—customers often cancel high-value orders due to lack of visibility and long wait times. These cancellations are costly, not just in lost revenue but in mounting storage fees incurred by unsold products sitting at last-mile logistics hubs. We will proactively address this issue by creating a retention strategy that matches idle inventory at last-mile hubs to customers at high risk of cancellation. By offering expedited delivery using existing inventory, we will reduce refunds, decrease storage costs, and improve customer satisfaction.

Goals

Reduce overall order cancellation rate by at least 15%

Cut last-mile storage costs by at least 15%

Improve average time-to-resolution for at-risk orders by 40%

Project Scope

This program will span logistics, customer support, and data teams. We will focus on customers whose orders are delayed past the five-week mark—identified as the point of highest cancellation risk. The system will surface available inventory at nearby hubs and allow trained agents to offer expedited shipping if criteria are met. MVP will cover high-value orders with known inventory match. We will exclude broad logistics or shipping contract changes.

User Personas

We are designing this solution for:

A logistics-sensitive buyer who cancels quickly if delivery expectations aren’t met

A patient but communication-driven buyer who expects transparency and responsiveness, and is prone to cancel if kept in the dark

David Kim

Age: 29

Location: New York, NY

David is a tech-savvy New Yorker who transitioned from gym to home workouts. He values premium experiences and has a high bar for service expectations. If fustrated with the purchase experience, he is quick to seek alternatives and finds unclear communications a huge turn-off as he highly prioritizes building brand loyalty.

Goals & Motivation: David wants seamless, on-time delivery for premium purchases and expects proactive communication.

Frustrations: Delays without updates frustrate him. If he doesn’t receive clear timelines or resolution options, he will cancel and leave negative feedback.

Rachel Simmons

Age: 34

Location: Austin, TX

Rachel is a young professional who’s willing to invest in high-quality fitness gear but expects brands to deliver reliably. She’s understanding—up to a point—but easily loses trust when she feels ignored or left out of the loop.

Goals & Motivation: She wants reassurance that her order is still on track and values companies that go the extra mile to resolve issues.

Frustrations: Silence from customer service or ambiguous updates are major triggers for cancellation.

Requirements

P0 – Must-Haves (Launch Blocking):

We will create a real-time dashboard that maps unsold inventory stored at last-mile hubs to corresponding zip codes of delayed customer orders.

We will define a rules engine and approval workflow to ensure expedited shipping is only offered when verified inventory is available and the unit can reach the customer in less time than the original ETA.

We will build a flagging system that automatically marks orders approaching the 5-week delay mark and notifies the customer support team.

A detailed SOP will be created to guide reps through the retention offer, including call scripts, escalation paths, and logging requirements.

P1 – High Impact Features (Enhance Utility):

We will build a tracking system to log every expedited offer, including whether the customer accepted, declined, or canceled anyway.

CRM records will be automatically annotated with the retention offer and outcome for internal reporting.

Weekly reporting will be generated to show revenue saved, refunds prevented, and regional differences in fulfillment success rates.

Training sessions will be provided for CS agents to practice outreach with real inventory constraints.

We will develop a feedback loop from CS to logistics to adjust eligibility logic based on what customers respond to.

P2 – Future Enhancements (Post-MVP Quality-of-Life):

An automated notification system will alert CS teams when orders hit the five-week threshold

CRM tags will be created to track “retention-attempted” and “retention-success” cohorts for future campaigns

A post-delivery NPS survey will be sent to measure customer sentiment on retention outreach

A logistics heat map will be created to visualize where inventory is commonly underutilized

Launch Plan / GTM

Considering the severity of the financial implications these order cancellations have on the company’s bottom-line, we will need to act with a high sense of urgency, yet be meticulous on how we launch. In order to keep light on our feet, we will have weekly syncs with logistics and support teams for key issues and be agile with decision-making. To launch we will follow the following timeline:

Week 1: Finalize SOPs, validate inventory accuracy, and define user cohort

Week 2: Train CS team and test process using mock outreach

Week 3: Begin live outreach to customers flagged for expedited delivery

Post launch, we will maintain a weekly meeting to discuss progress and iterate if there are unforeseen issues with the new product offering.

Risks

Risk of CS agents offering expedited delivery when inventory is already reassigned

Misalignment between CS and logistics could delay customer outreach or create false expectations

Lack of clear tracking could undermine ability to calculate savings or ROI

If the retention offer appears too transactional, it may not meaningfully improve sentiment or brand loyalty